Common Accounting System For Pacs Software

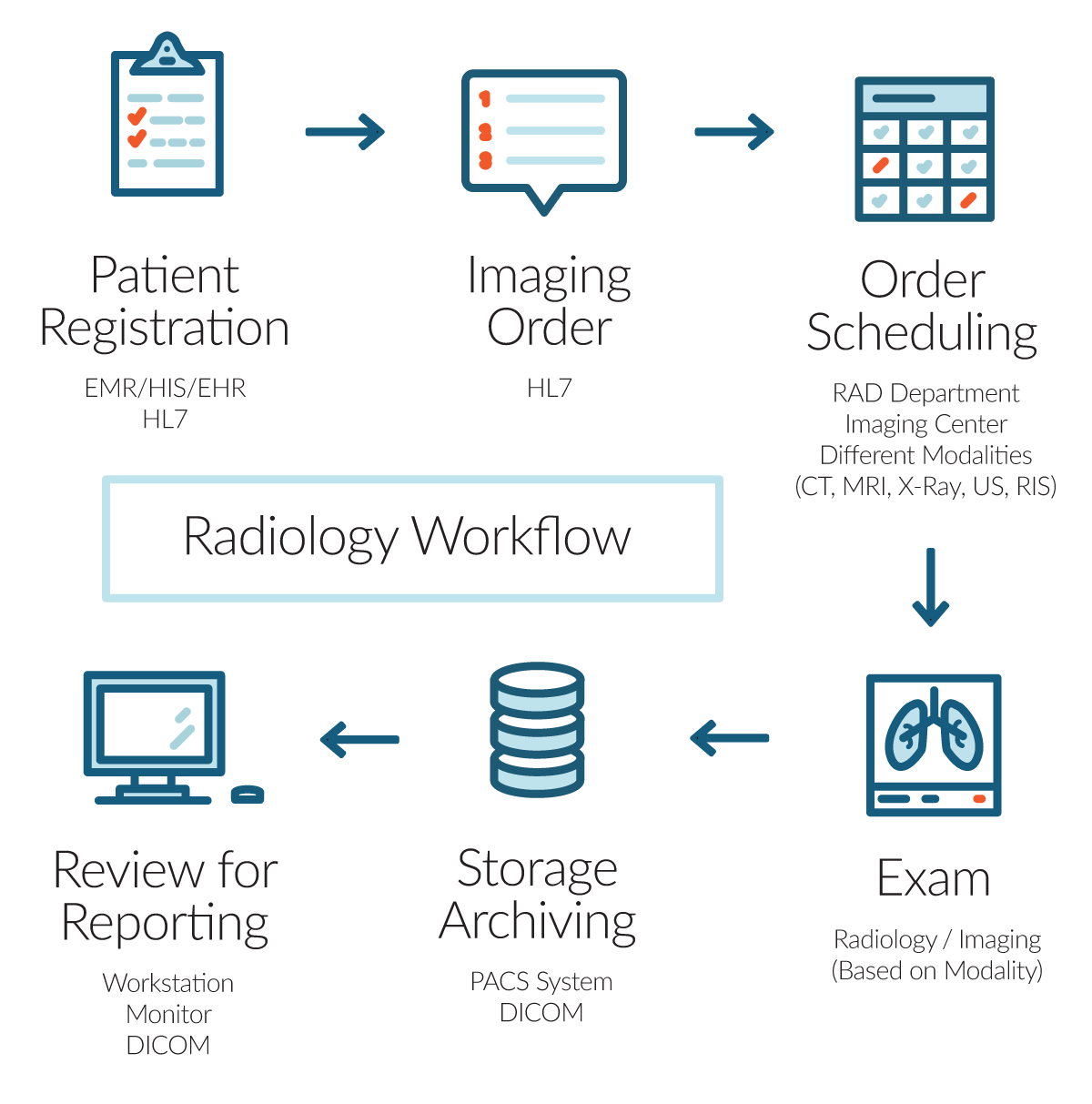

Solver Accounting Software Provides a graphical tree structured and flexible chart of accounts. The Accounts Tree offers the most convenient way to manage accounts. You can Group, ungroup, and regroup your accounts, change account specifications, modify or delete them at any time. Accounts payable software refers to systems that are used for accounting and financial processes. These solutions range from basic single-entry apps for bookkeeping and check writing to advanced double-entry programs that offer a general ledger, and accounts payable. Mar 05, 2021 Compatible with NABARD System Our PACS Software is fully compatible with NABARD oriented CAS (Common Accounting System). It assures that all recommended settings and configuration measurements have been followed properly as mentioned in the CAS. Search and Find Details. The Three Main Functions of a PACS. Storage: As you create images, your digital system can be configured to send all those images immediately to your PACS for long-term storage. Distribution: Your PACS is a central hub that allows your users to have secure on-demand access to patient folders at the click of a button. Viewing: Most PACS solutions include DICOM view licenses that allow users to.

Payroll Accounting System (PACS)

PACS is an internal financial management system of NFC. PACS processes over 500,000 accounts. The system computes and reconciles payroll appropriation charges, feeds information to other systems, and produces numerous external and internal reports and Standard Forms. PACS has two distinct, functional sides: accounting and reporting.

PACS accounting is referred to as the front-end processing of payroll information which includes:

- Computation of employee benefits

- Conversion of transaction codes to object classification codes for updating to the Central Accounting System

- Distribution of monies from employee deductions

- Validation of accounting data and treasury accounting symbols

- Balancing of employee records (i.e., gross pay to net pay)

PACS reporting is considered to be the back-end processing of payroll information. After PACS accounting has computed and processed the data, the reporting side handles the distribution of monies such as charitable contribution and State and Federal taxes (excluding financialallotments), which are reported to outside entities. PACS reporting provides a wide array of external and internal reports and forms. These reports/forms are disseminated to various entities, such as client Agencies, other Federal Agencies and Departments, health and life insurance carriers, etc.

See Also |